Notice regarding the establishment of fiduciary business as an open platform for corporate engagement

Sumitomo Mitsui Trust Holdings, Inc.

Sumitomo Mitsui Trust Bank, Limited

Corporate Directions, Inc.

Industrial Growth Platform, Inc.

Misaki Federation, Inc.

The Bank of Kyoto, Ltd.

Kiraboshi Bank, Ltd.

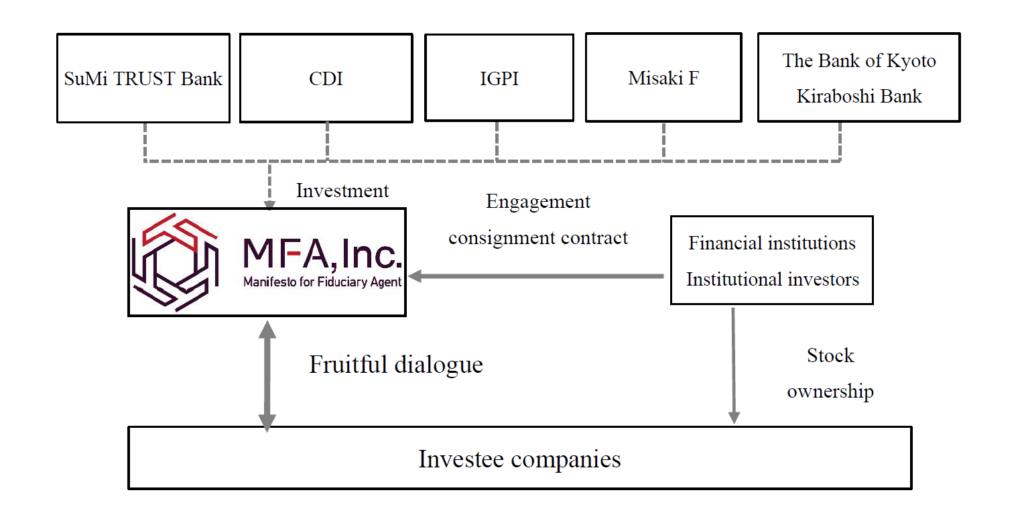

We hereby announce that Sumitomo Mitsui Trust Holdings, Inc. (Director, President: Toru Takakura; hereinafter “SuMi TRUST Holdings”), Sumitomo Mitsui Trust Bank, Limited (President: Kazuya Oyama; hereinafter “SuMi TRUST Bank”), Corporate Directions, Inc. (Representative Director: Kotaro Ishii; hereinafter “CDI”), Industrial Growth Platform, Inc. (Managing Partner: Takashi Muraoka, hereinafter “IGPI”) and Misaki Federation, Inc. (Representative Director: Yasunori Nakagami; hereinafter “Misaki F”) have established a joint venture “MFA, Inc.” (President: Kotaro Ishii; hereinafter “MFA”) that engages in the business of “representing and advising on engagement with investee companies on behalf of shareholders including financial institutions and institutional investors” (the fiduciary agent business).

The Bank of Kyoto, Ltd. (President: Nobuhiro Doi; hereinafter “The Bank of Kyoto”) and Kiraboshi Bank, Ltd. (President: Hisanobu Watanabe; hereinafter “Kiraboshi Bank”) have joined in MFA through the transfer of part of the stake owned by SuMi TRUST Bank.

1. Background & objective

In Japan, multiple policy reforms have been carried out in the capital markets, with the aim of promoting the sustainable growth of companies and the medium- to long-term enhancement of corporate value, including the establishment of the “Corporate Governance Code,” which is a compilation of principles that contribute to the realization of effective corporate governance for companies, the “Stewardship Code,” which sets forth principles considered useful for institutional investors in fulfilling their stewardship responsibilities as “responsible institutional investors,” and the “Guidance for Collaborative Value Creation,” which serves as the common language to encourage and facilitate dialogue between companies and investors. These initiatives have helped raise awareness of the importance of dialogue between companies and investors, both of which are seeking constructive and substantive ways to engage in such dialogue. In particular, financial institutions and institutional

investors are increasingly expected, on behalf of all shareholders and as “responsible investors” distinct from ordinary investors, to engage in beneficial dialogue that leads to medium- and long-term growth and value enhancement of companies. Engaging in high-quality “fruitful dialogue” with companies has come to bear great importance. MFA was established by the four companies sharing a common understanding of this background, with the intent of contributing to the resolution of the above issues by building and presenting a model for “fruitful dialogue” with companies, from the standpoint of multiple stakeholders, including clients, business partners, employees, and local communities, instead of simply acting as specific shareholders.

The Bank of Kyoto and Kiraboshi Bank, who both support the founding objectives of MFA, have decided to participate in MFA from its inception.

2. Overview of MFA and the value it provides

MFA will engage in the “fiduciary agent business” which is new to Japan, representing and advising on engagement from a multi-stakeholder perspective rather than from the standpoint of specific shareholders, on behalf of shareholders including financial institutions and institutional investors.

MFA will support the companies it engages with by focusing on their intrinsic and latent value, conducting “fruitful dialogue” with an understanding of the top management’s standpoint while maintaining an objective perspective, and progressing hand in hand as the investee companies achieve medium- to long-term development and growth. MFA will also actively support the disclosure of strategies and scenarios for value creation, thereby gaining the understanding and support of various stakeholders, which will heighten both economic value (long-term improvement in stock price) and social value of the company.

(Examples of engagement themes)

●Long-term business strategy and vision, business portfolio management, developing the next-generation management team, effective use of financial and non-financial capital (including human capital), sustainability-focused management, achieving carbon neutrality, etc.

On the other hand, for the shareholders including financial institutions and institutional investors, which are the clients, MFA will contribute to enhancing their ability to engage with companies, which is required of them as “responsible investors,” and to fulfilling their responsibility to powerfully encourage the development and growth of investee companies through high-quality dialogue. We believe MFA will, as a result, generate both direct and indirect value, such as medium- and long-term improvements in the stock price of investee companies, creation of new businesses, development and growth of local economies, and the revitalization of local communities.

3. The role of the four founding members

The four founding members of MFA will contribute to the business by bringing together their respective strengths and characteristics:

(1) SuMi TRUST Bank will provide the opportunity to launch the business and, based on the results, expand the circle of empathy and contribute to finding new companies to engage with.

(2) CDI will contribute to the growth of the business by providing its expertise in management strategy planning and implementation support, which it has been practicing as the first independent management consulting firm in Japan. CDI will also focus on bringing in talent with engagement expertise, by utilizing its network and connections in the consulting industry.

(3) IGPI will contribute by offering its expertise in corporate transformation (CX), which refers to the integrated transformation not only of business strategy and operations, but also of corporate values, culture and the management structure itself, based on the knowledge through “on-site collaboration (Hands-on)-style growth support” to companies with the aim of long-term and sustainable enhancement of corporate and business value.

(4) MFA was established based on a concept that arose through the many years of engagement investing activities by Yasunori Nakagami, Representative Director of Misaki F, who has been supporting the founding of MFA by providing his ideas, expertise, personal relationships and other resources. Mr. Nakagami will continue to contribute in developing the “fiduciary agent” concept, as well as in the expansion of the business.

4. The fiduciary agent business

The fiduciary agent business which MFA will engage in is not about taking action based on the interests of specific shareholders, but rather as an entrusted fiduciary, taking the perspectives of all stakeholders, including general shareholders, clients and employees who interact with the company, as well as the social and natural environment which is a silent stakeholder. MFA will aim to be an intermediary for better dialogue between senior management and responsible shareholders, discussingwhat is best for the company.

As the pioneer of the fiduciary agent business in Japan, and by promoting “fruitful dialogue” between companies and investors, MFA will further stimulate the capital market in Japan and contribute to the sustainable growth of Japanese companies and the ensuing revival of the growth potential of the Japanese economy.

5. Future outlook as an open platform

In the future, as an open platform, MFA aims to expand beyond the current six companies, allowing various stakeholders who understand and support the business concept and the realization of high-quality engagement to participate.

6. Overview of MFA

(As of April 21, 2023)

| Name | MFA, Inc. |

| Representatives, etc. | Representative Director: Kotaro Ishii (Representative Director of CDI) Director (Non-executive): Naonori Kimura (Partner, IGPI) Director (Non-executive): Shigeki Tanaka (Deputy President, SuMi TRUST Bank) Auditor (Non-executive): Yoshihide Haze General Manager of Internal Audit Department, SuMi TRUST Holdings |

| Capital | JPY 60 million |

| Main business | Fiduciary agent business |

| Shareholder composition | SuMi TRUST Bank 36%, CDI 25%, IGPI 20%,Misaki F 15%,Bank of Kyoto 2%, Kiraboshi Bank 2% |

<Shareholder information>

| Name | SuMi TRUST Bank |

| Representative | Kazuya Oyama, President |

| Established | July 1925 |

| Capital | JPY 342 billion |

| Name | Corporate Directions, Inc. |

| Representative | Kotaro Ishii, Representative Director |

| Established | January 1986 |

| Capital | JPY 96 million |

| Main business | Consulting services on all aspects of management from strategy to implementation of change, including management and business strategy planning, operational and organizational reform, human resource development, corporate acquisitions and alliances |

| Name | Industrial Growth Platform, Inc. |

| Representative | Takashi Muraoka, Managing Partner |

| Established | April 2007 |

| Capital | JPY 3.1 billion |

| Main business | Enhance long-term and sustainable corporate and business value through strong partnership and collaboration with clients – Management supports for companies and businesses in various development stages, including growth support, start-up support, and turnaround support – |

| Name | Misaki Federation, Inc. |

| Representative | Yasunori Nakagami, Representative Director |

| Established | April 2022 |

| Capital | JPY 10 million |

| Main business | Provide support to businesses related to the business objectives of Misaki Capital Inc., which makes engagement investments in listed companies |

| Name | The Bank of Kyoto, Ltd. |

| Representative | Nobuhiro Doi, President |

| Established | October 1941 |

| Capital | JPY 42.1 billion |

| Name | Kiraboshi Bank, Ltd. |

| Representative | Hisanobu Watanabe, President |

| Established | May 2018 |

| Capital | JPY 43.7 billion |

Contacts:

Naonori Kimura / Ryuichi Takahashi

Tel: 81-3-4562-1111

e-mail: info_igpi@group.igpi.co.jp